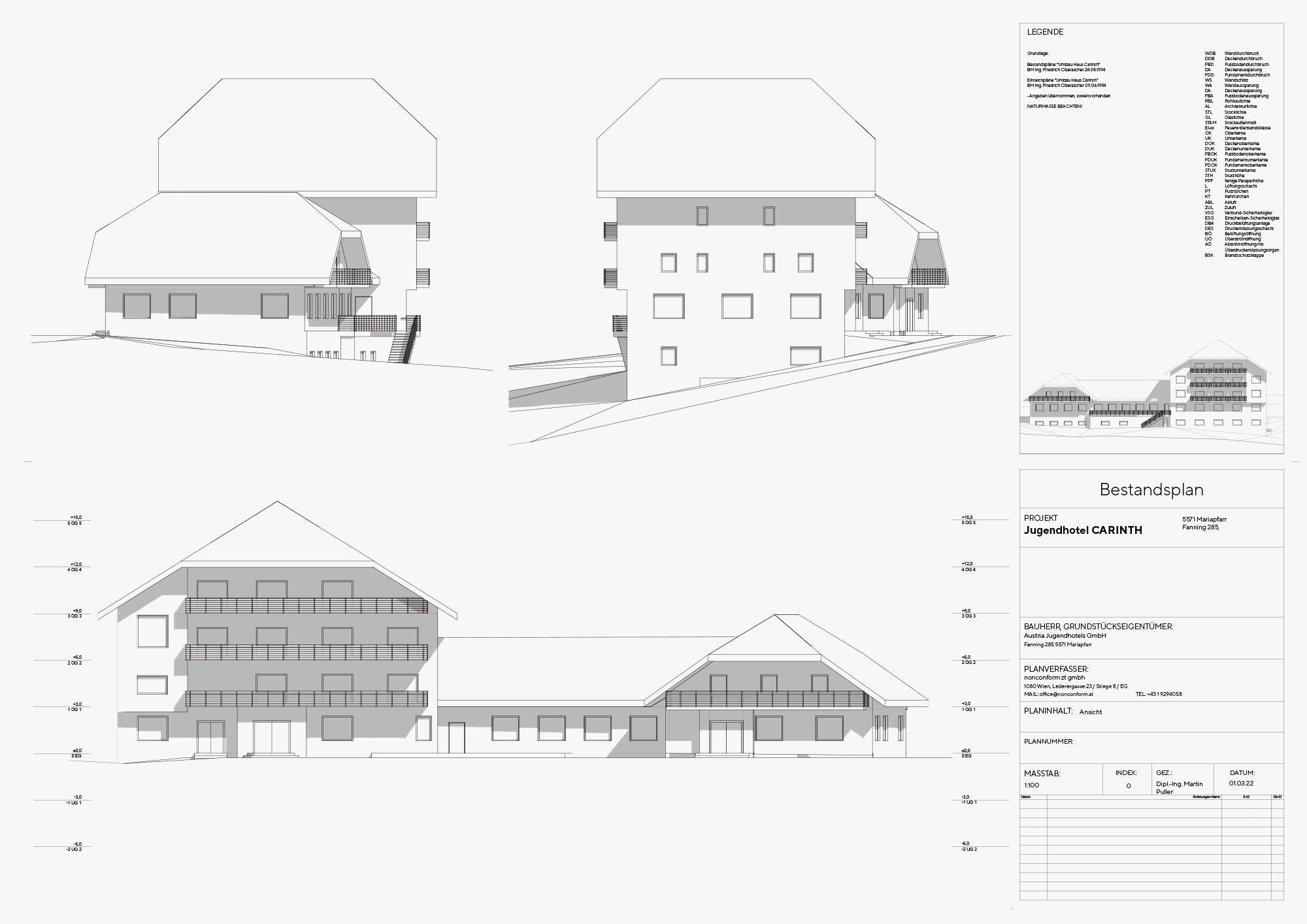

The views of the building.

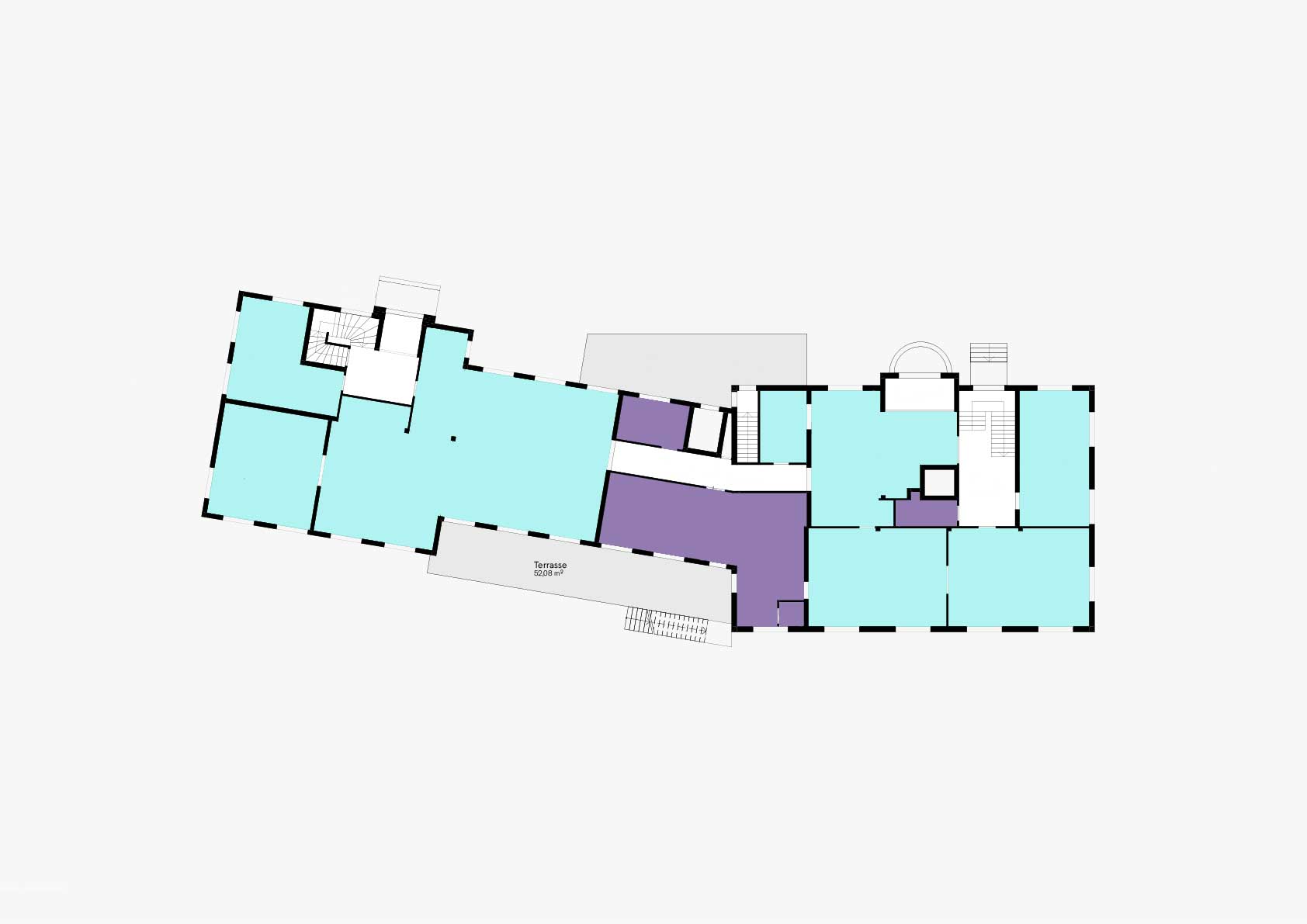

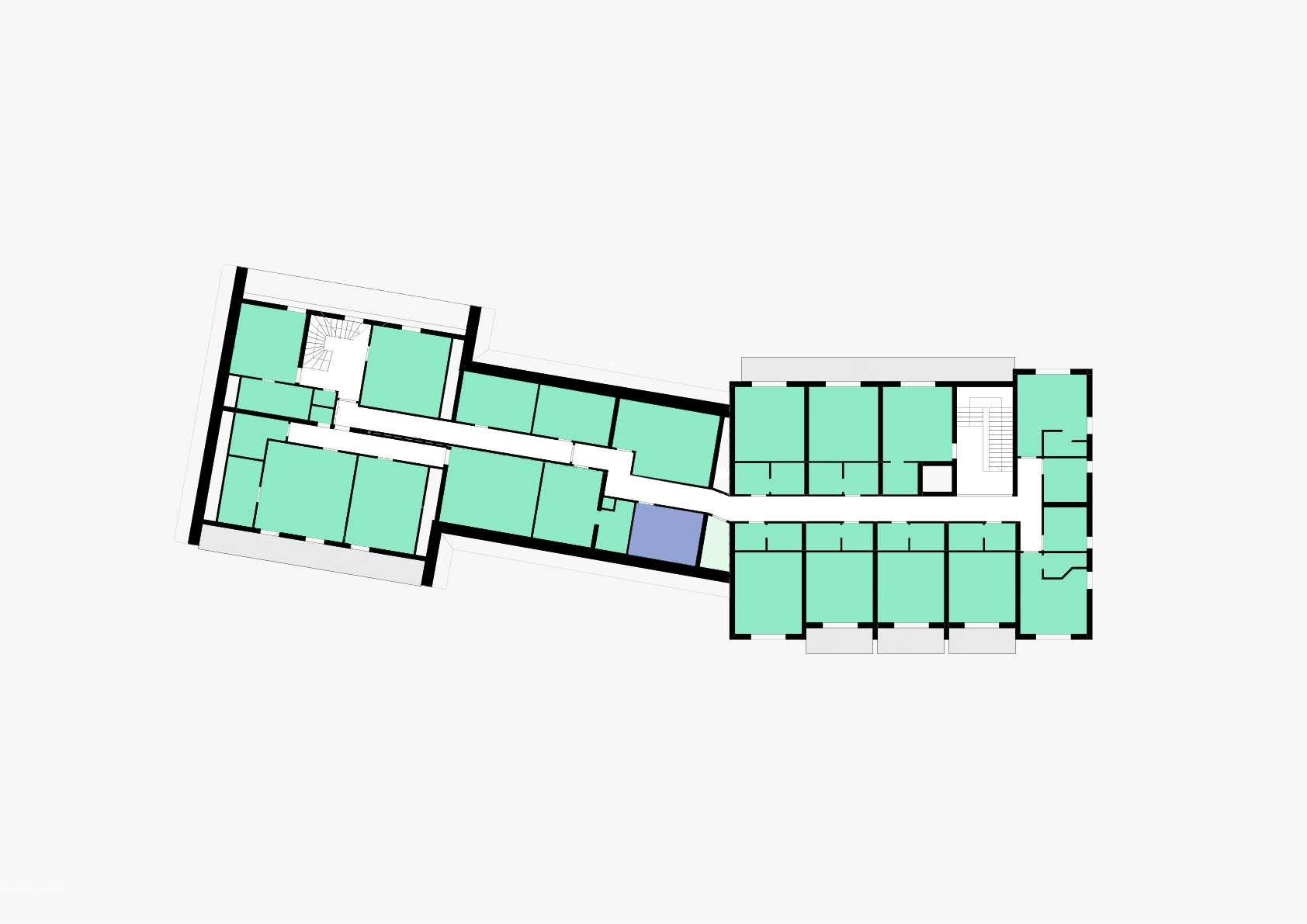

The usable areas of the building. In total, the existing building comprises around 2,590 m2 of floor space.

Living

Grounds

Lounges

other

The primary system. There are two static systems within the existing building. The northeastern component consists of load-bearing exterior and interior walls in the grid of the room partitions. The southwestern part is structurally more open.

Hotel Carinth in Mariapfarr, located in the Salzburg Lungau region, has been a part of a professional network of accommodations for youth travel by Young Austria for 48 years. It is one of the 16 unique experiential guesthouses in Austria.

We have developed a future concept for this location, based on extensive research on tourism trends, changes in consumer behavior, and an analysis of the building conducted by our partner nonconform.

Below is a compilation of the research findings for this project.

Usage and areas

Usable space on the 1st floor

< 20

35 – 30

100 – 200

> 200

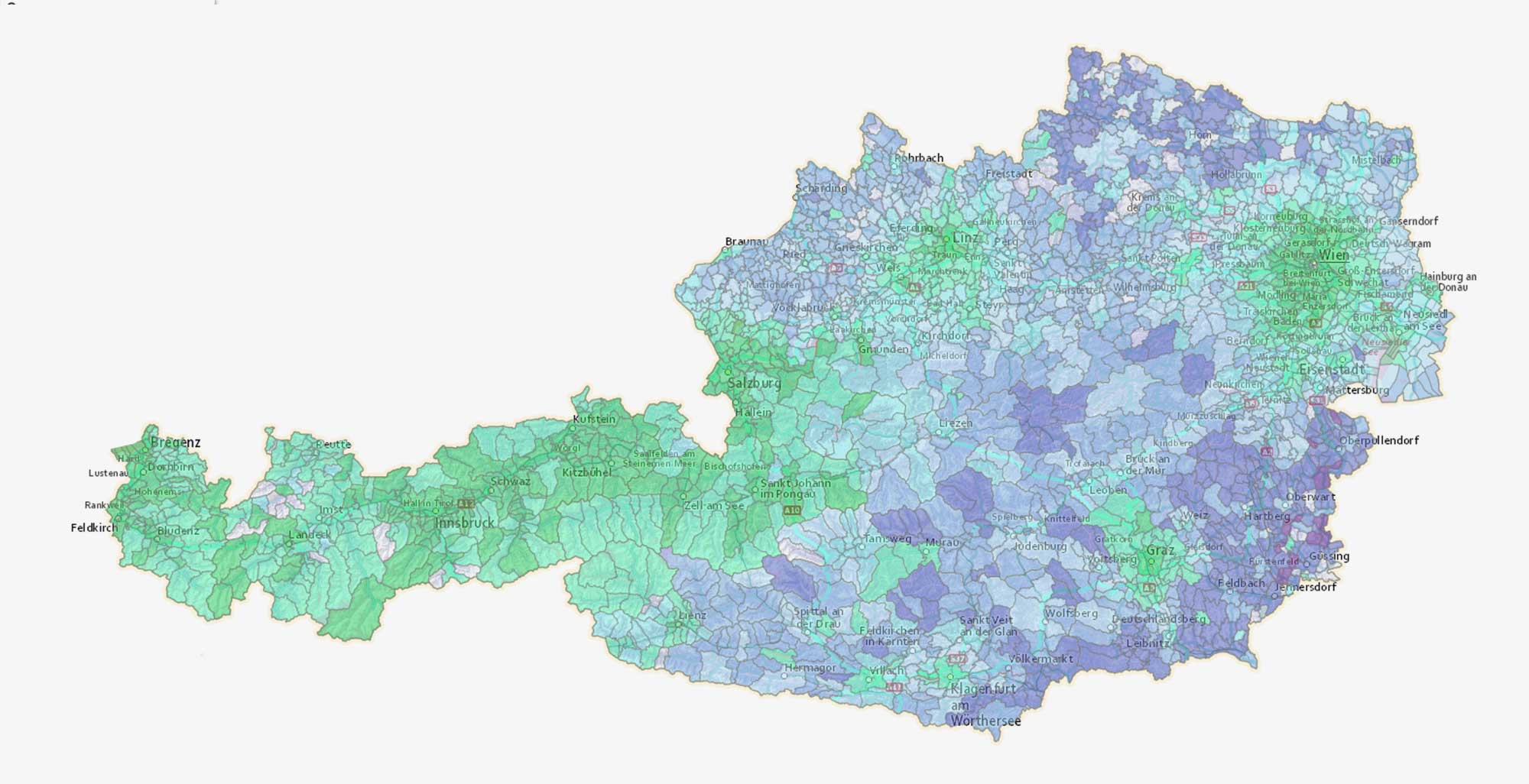

The Lungau in Salzburg: With the second-highest gross regional product per capita, Salzburg is one of Austria’s most vital economic provinces.

Area 7,154.56 km2

Population 560,710

Gross / capita 49.900 €

The proportion of senior citizens in 2040 in Lungau.

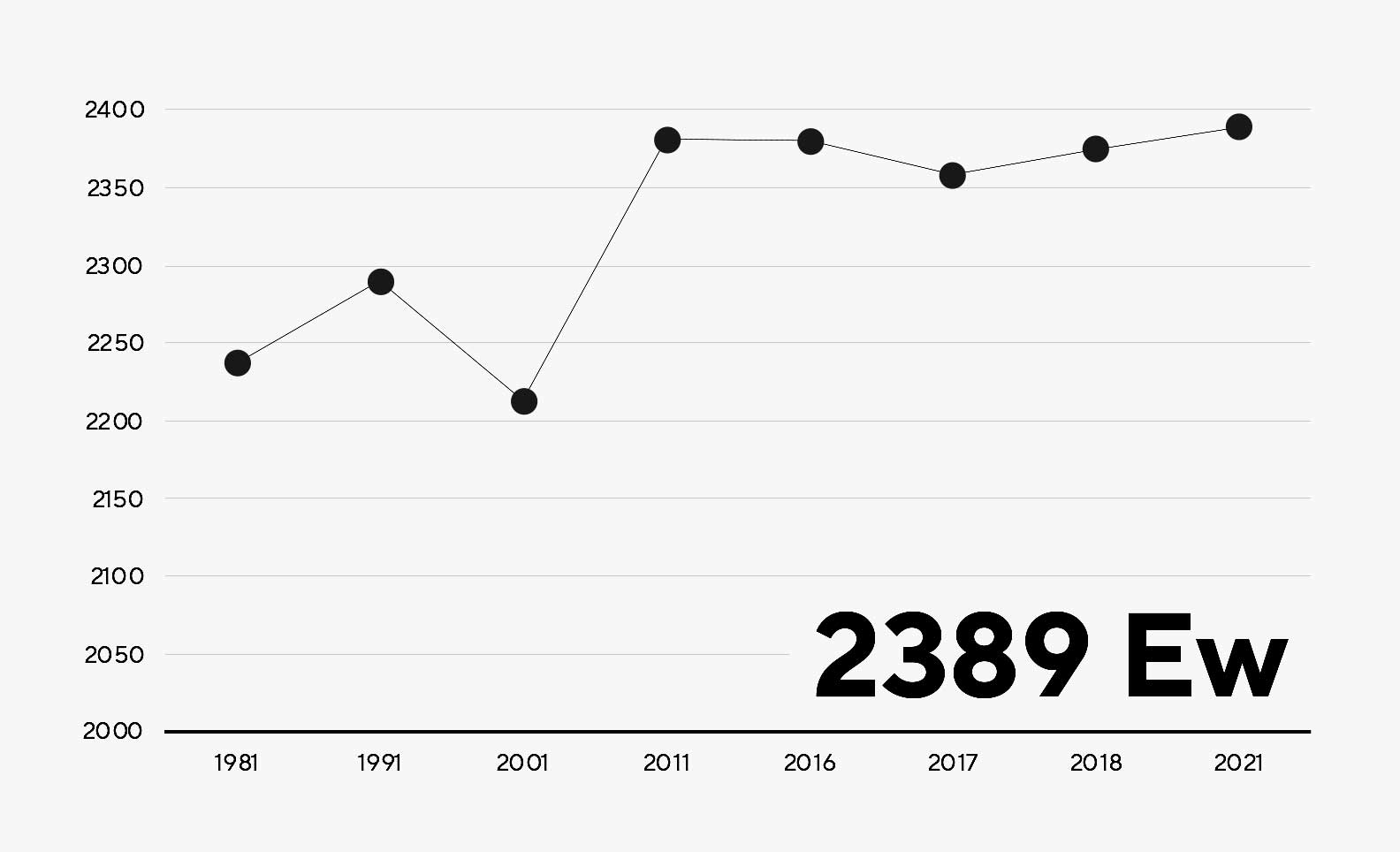

Mariapfarr Development of the population since 1981. The Lungau is the only region in Salzburg confronted with a population decline and holds the highest proportion of senior citizens in Salzburg.

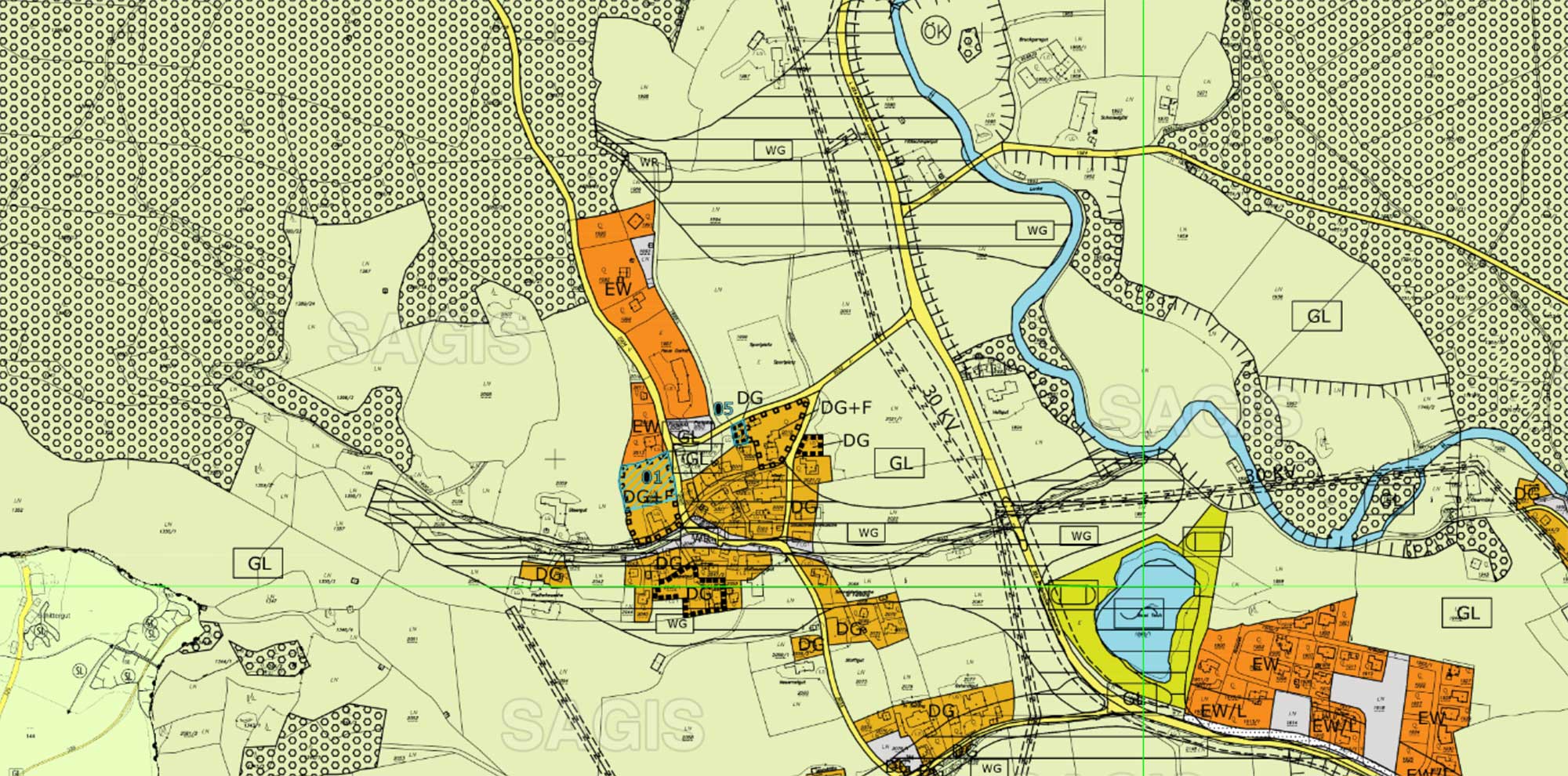

Dedication and development

In addition to housing, zoning also enables operational uses, provided they do not cause odour or noise pollution, air pollution, excessive traffic congestion or vibrations for the neighbourhood.

There is a development plan for the property and the surrounding area. The responsible spatial planning specifies a target density of 0.5 for residential use and 0.6 for residential use tourist use.

850 agricultural holdings

51% organic farming

346 farmed alpine pastures

Location Marketing: Lungau offers a tourist brand and marketing platform.

Bonus Card: Offers can be accessed as part of a bonus programme with the Lungau Card in summer and winter.

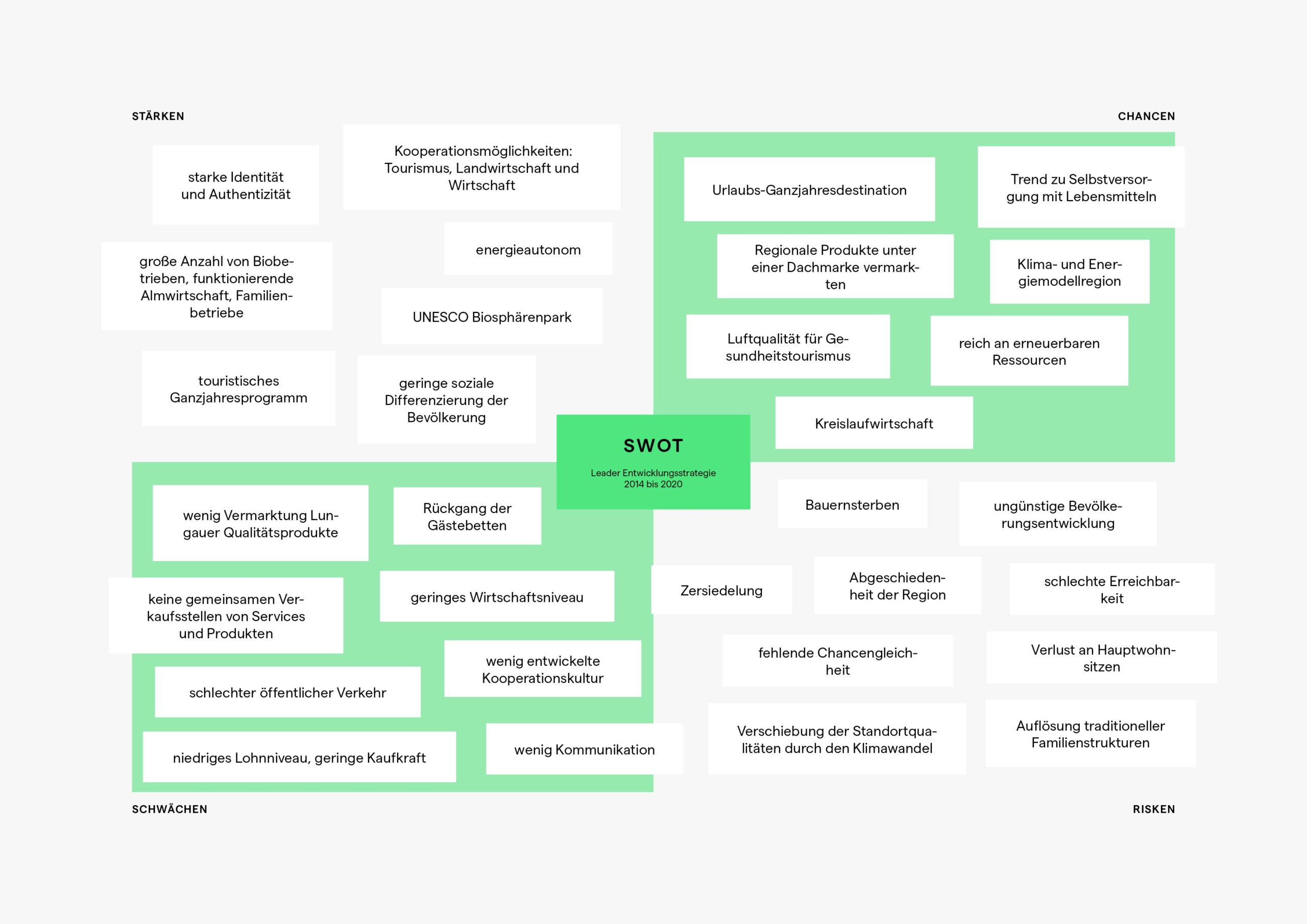

The SWOT Analysis

The development strategy 2014 -2020 for the Lungau: “Leader Region: Biosphere Lungau” shows the following opportunities in the region:

- Year-round destination

- Air quality

- regional food

- Natural jewel in the Alpine region

- Climate and energy model region

- rich in renewable resources

- regional circular economy

15 tourism associations

many private rooms

Winter season: 66% overnight stays

The future of tourism?

The desire to return to the level of tourism before the crisis is crowding out the difficulties that the climate crisis will bring to tourism offers. Travel will become more expensive, consumer demands will increase, and successful offers will have to convince at all levels.

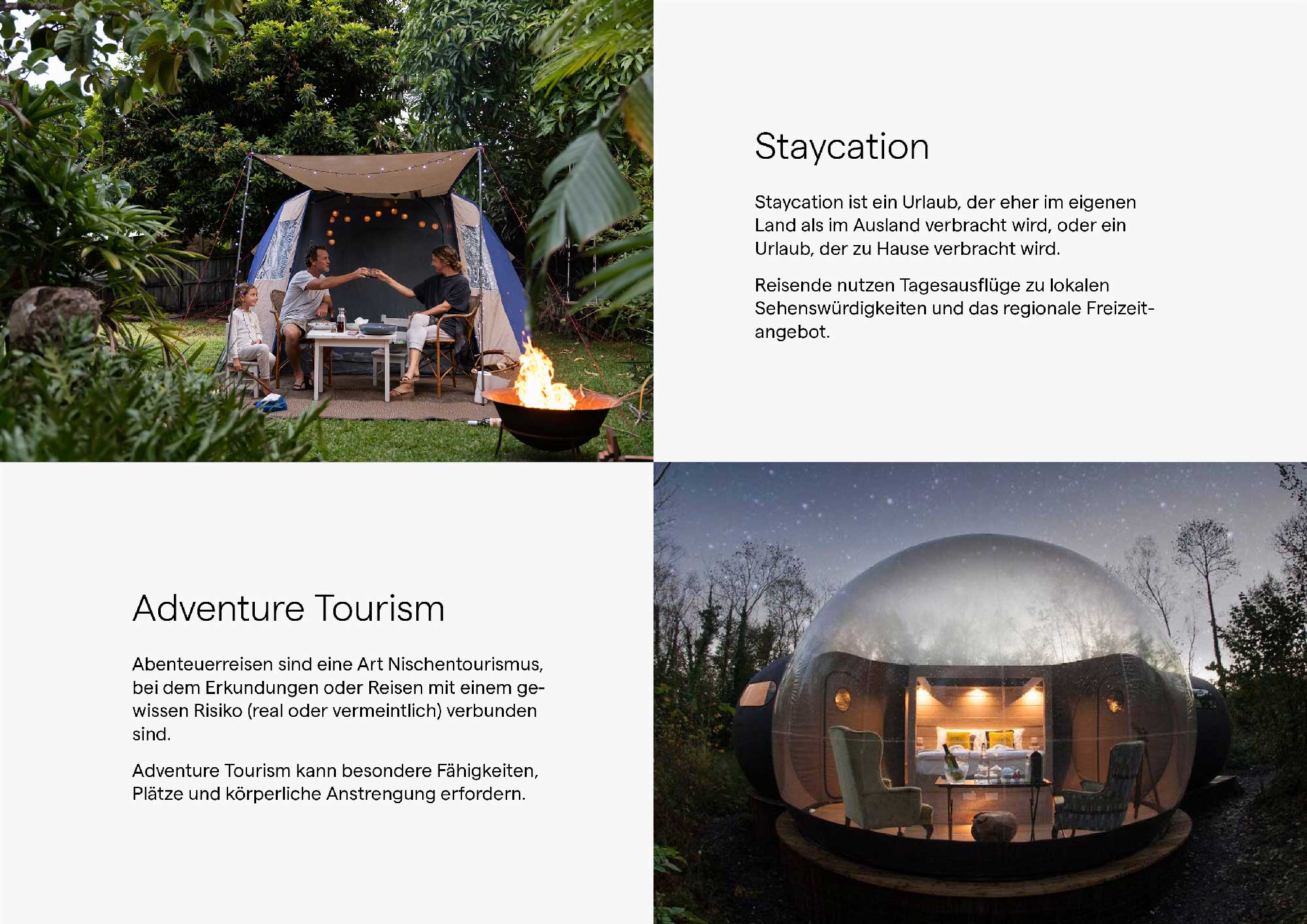

Tourist trends?

In addition to “Staycation” and “Adventure Tourism”, “Eco Tourism” and “Spiritual Tourism” are among the trends after the corona pandemic.

Trend research

The research included eight studies on regional development, tourism and consumer behaviour, and around 100 products and services.

The pandemic has affected our consumption patterns

Consumers expect transparency, flexibility, ethical behaviour and self-control.

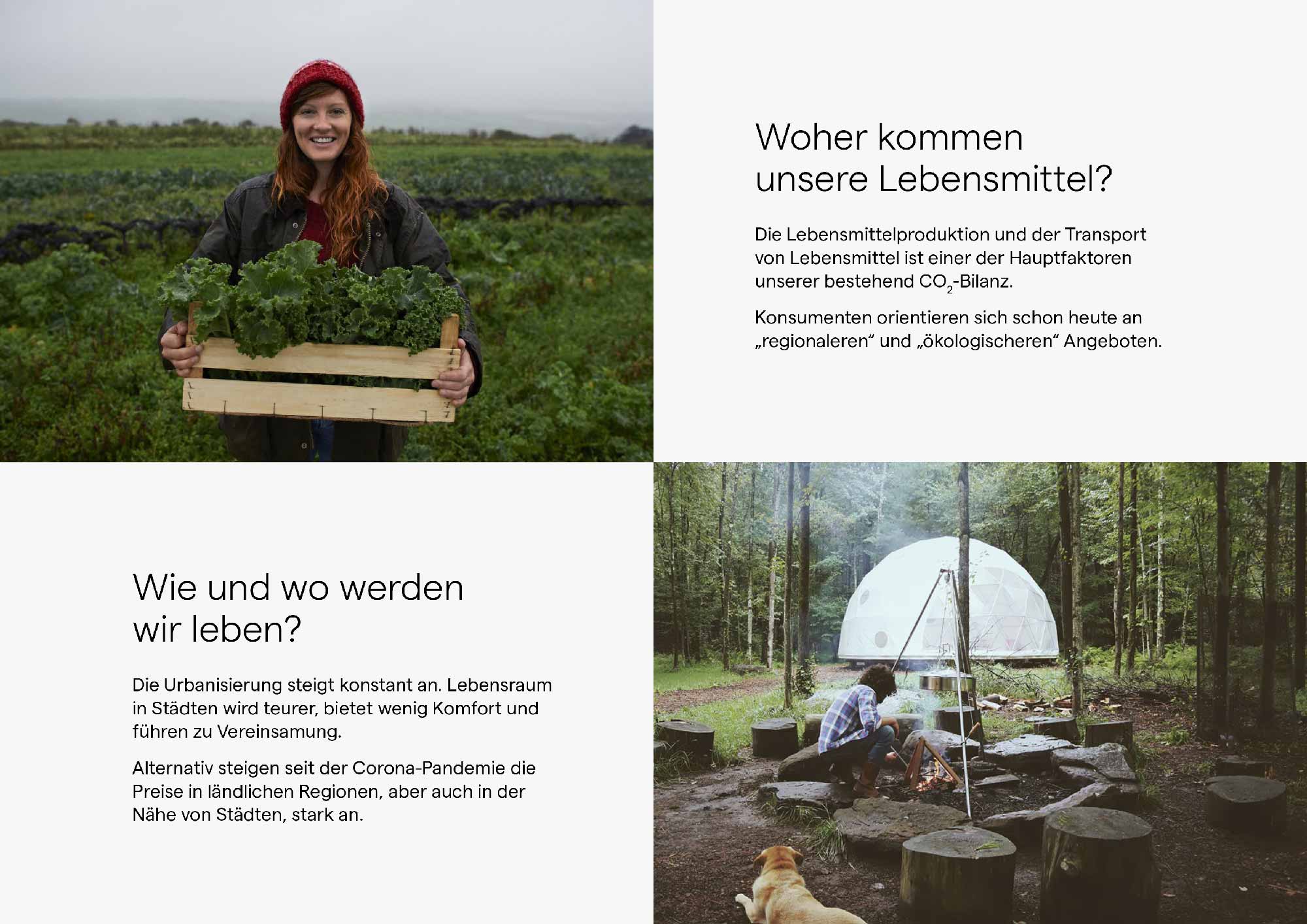

Where does our food come from?

Food production and food transport are two of the main factors of our existing CO2 balance. Consumers are increasingly orienting themselves towards more “regional” and “ecological” offers.

Do our children have a fair chance?

Education and other processes through which new knowledge and skills are acquired are critical economic multipliers. Young people in education today are the consumers of the next generation.

How will we move in the future?

Private transport has become expensive. Fewer cars will be used. The way and when we drive is changing. People will travel distances and visit other places.

How and where will we live?

Urbanisation is constantly increasing. Living space in cities is becoming more expensive, offers little comfort and leads to loneliness. Alternatively, since the corona pandemic, prices have risen sharply in rural areas and nearby cities.

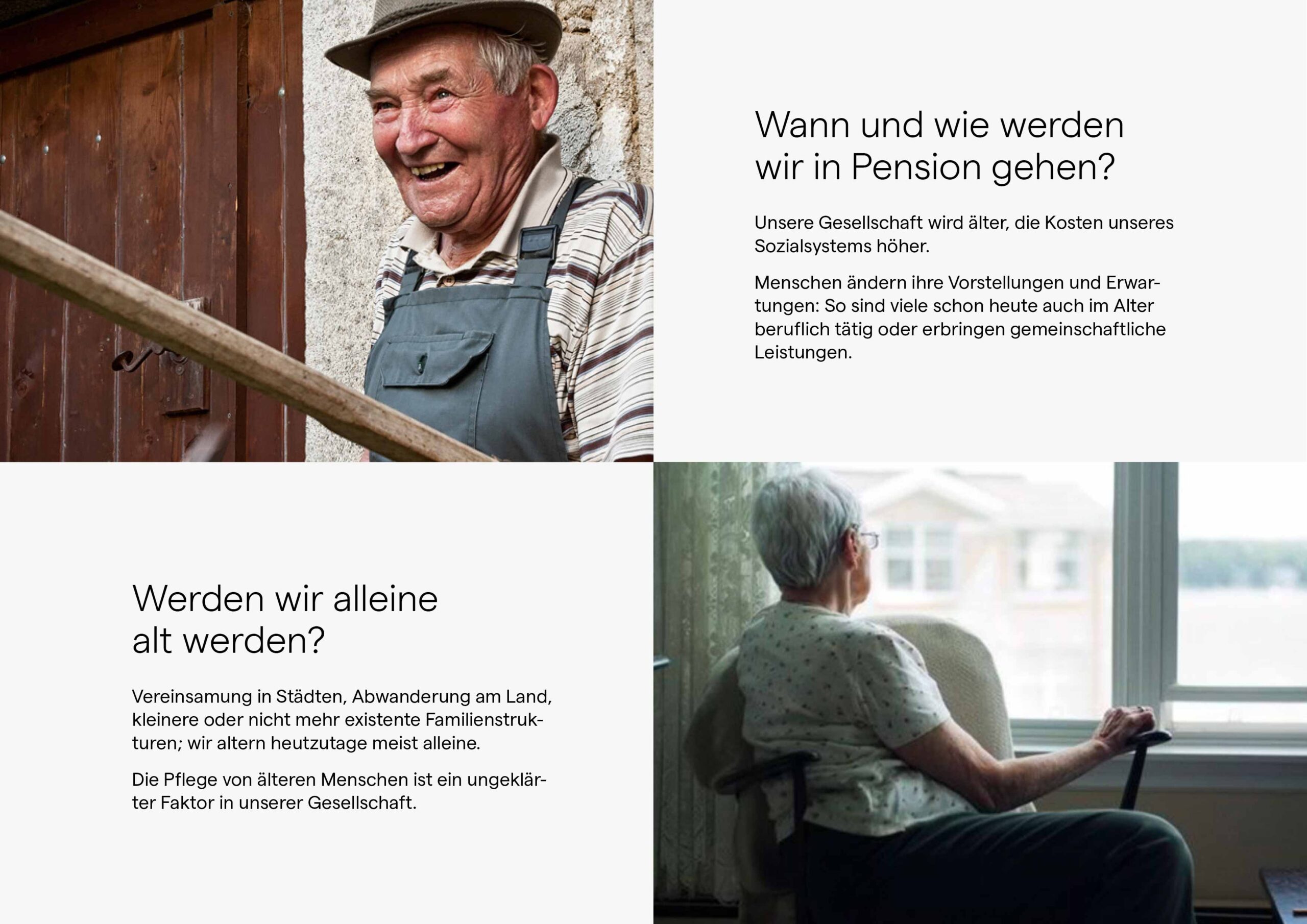

When and how will we retire?

Our society is getting older, and the costs of our social system are higher. As a result, people are changing their ideas and expectations: Many are already working in old age or providing joint services.

Can we benefit from climate change?

Eco-innovation and investment in resilient business models are on the rise. As a result, eco-patents overtook all other patent applications (OECD, 2016).

Do we need what we afford?

Income inequality, the gap between the poorest and wealthiest members of society, is reaching new extremes. This is because the richest 1% of humanity owns more wealth than the rest combined.

Will we grow old alone?

Loneliness in cities, emigration in the countryside, and smaller or no longer existing family structures; We usually age alone these days. So caring for the elderly is an unexplained factor in our society.

Stay in control!

In times of heightened uncertainty, consumers long for control over their lives. Precariousness and financial difficulties triggered by the pandemic and inflation, as well as alternative facts and fake news, create a sense of loss of control. Consumers want clarity, transparency, and flexibility.

Enjoyment: here and everywhere.

Consumers are eager to experience new things: virtually and in the physical world. Digital offerings have become the norm over the pandemic. Consumers are looking for fun and games in all areas of life. Every day is (again) met with appreciation.

Ethics check.

Consumers don’t want beautifully coloured words; they want action. They are less trusting than ever – they expect companies, governments and institutions to behave ethically. Companies must communicate production chains and the use of resources transparently, and ethical action must be an integral part of the business model.

The desire for flexible premises.

More than ever, offers and brands need to inspire consumers to experience something, not tell them how to share it. Work, play, life, fun, joy – whether digital or analogue – consumers want to participate where they are in the moment and not change places specifically for this purpose.

Baby Boomers, 1946 – 1964

The baby boomer generation has experienced a robust economic upswing with high growth rates. The peace and environmental movements fall into their time; economically, only a few crises (oil crises) must be overcome. This generation is focused on competition, attention and individuality.

Generation X, 1965 – 1980

Generation X has been shaped by significant technological progress, expansion of environmental protection, environmental disasters), the integration process of the EU, economic crises and growing unemployment, and rising divorce rates. Work is a central part of life; alternative, individual life plans and work-life balance are essential.

In 2040, “Generation X” people will make up 28% of the local population.

In addition, it can be observed today that more and more older individuals are choosing travel destinations that are closer in proximity than before. Heightened environmental awareness and the desire for tranquility and simplification have given rise to a new group of consumers from the Baby Boomer and Generation X generations for tourism offerings.

Baby boomers continue to be active and engaged. They are developing business ideas, undertaking projects, starting businesses, and forming new relationships. The older generation, also known as the Silver Society, remains active in various forms and ways. This keeps them mentally and physically healthy and provides them with strong social connections.

“Hospital at home” and increasing digital consumption impact older adults’ health technologies.

One of the big questions of getting older is: “Where do I want to live in old age?” For many baby boomers, staying self-reliant for as long as possible is an important goal.